(Click here for best resolution)

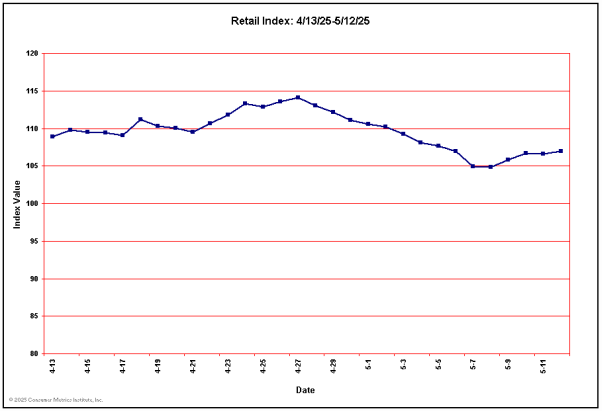

Last 10 Retail Index Values

| Date: | 03/20/2025 | 03/21/2025 | 03/22/2025 | 03/23/2025 | 03/24/2025 | 03/25/2025 | 03/26/2025 | 03/27/2025 | 03/28/2025 | 03/29/2025 |

| Value: | 104.28 | 106.22 | 106.82 | 107.86 | 106.92 | 106.15 | 105.26 | 104.18 | 103.45 | 101.59 |