(Click here for best resolution)

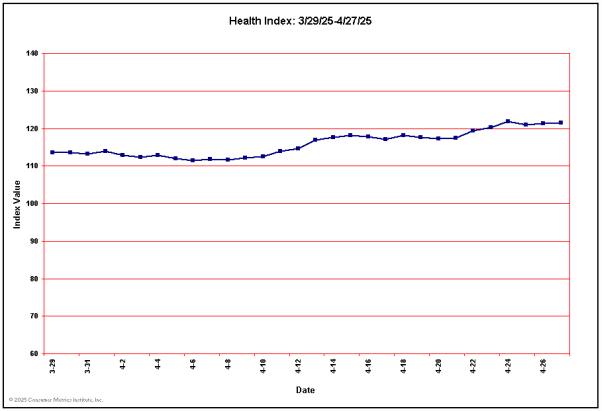

Last 10 Health Index Values

| Date: | 03/20/2025 | 03/21/2025 | 03/22/2025 | 03/23/2025 | 03/24/2025 | 03/25/2025 | 03/26/2025 | 03/27/2025 | 03/28/2025 | 03/29/2025 |

| Value: | 111.92 | 113.43 | 114.54 | 115.40 | 115.34 | 115.37 | 115.82 | 115.84 | 114.20 | 113.53 |